Cryptocurrency is a digital asset designed to work as a medium of exchange. It uses strong cryptography to ensure secure financial transactions, control the creation of new units, and verify the transfer of assets. The market for cryptocurrency is very volatile. It may turn pennies into millions in an instant; the other way around is plausible too. It will take time for the market to set, but cryptocurrency is here to stay.

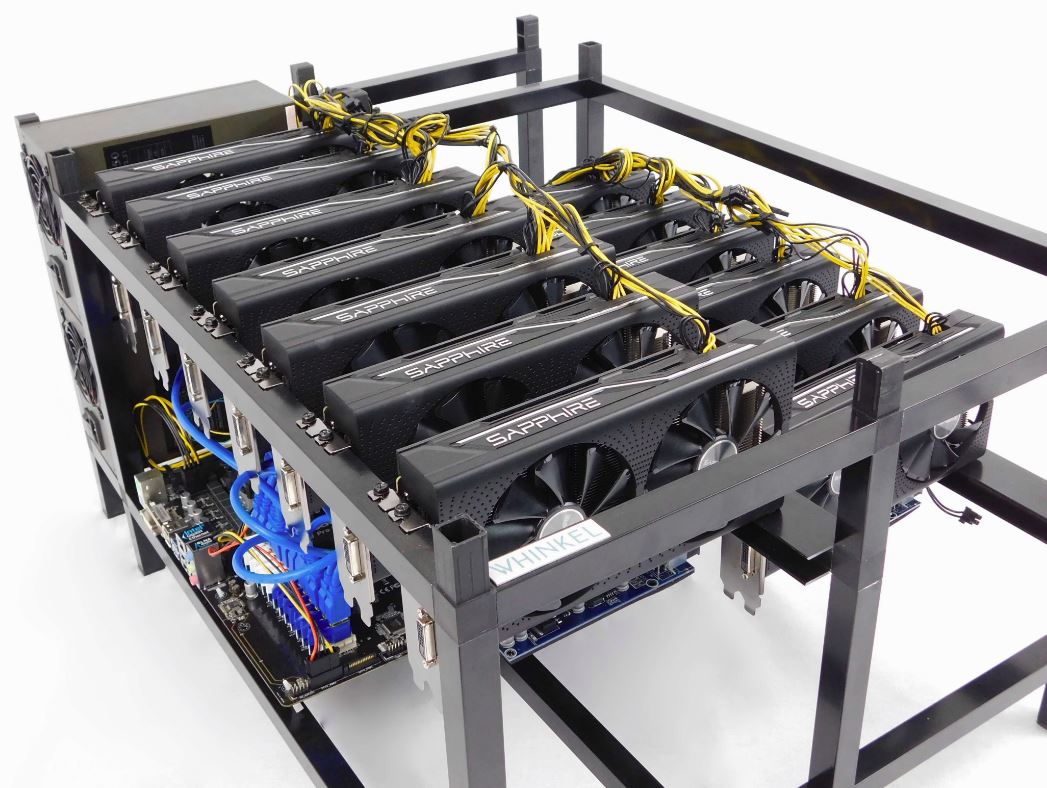

If we look at the crypto market structure of 2017, we can see that the market was increasing exponentially. People were making unusual returns on their investments, and hence the “unregulated” market was favoring almost everyone in it. The prices of GPUs skyrocketed at that time since huge demand was not satisfied by the limited supply capabilities of the fabrication companies. The high processing power of GPUs was the key to mine cryptocurrencies such as ethereum or Bitcoin, hence “crypto miners” took these GPUs in high quantities and got high returns on their investments.

Financial markets are random, but they are regulated in such a way that there are no unusually high returns unless there is an anomaly such as the arbitrage conditions. The cryptocurrency markets are not regulated anywhere in the world; that is why we see a very haphazard pricing structure that solely depends upon the supply and demand. It is the responsibility of governments to regulate these markets so that more people can enter and invest.

The Republic of Korea (South Korea) became the first country to pass legislation that will provide a framework to legalize and regulate cryptocurrencies and crypto exchanges. In a unanimous vote during the special session of the legislature convened, the representatives passed an amendment to their financial services laws. The law authorizes Korea’s financial regulator to oversee the market in incubation and effectively develop rules that will revolve around allowed financial activities and prohibits money-laundering and other false activities.

The law was passed because South Korea was at the forefront of the cryptocurrency boom and bust over the last two to three years. It was one of the few countries where cryptocurrency was actively accepted as a medium of exchange. Surveys suggest that more than the 3rd of the country’s population was investing in the market. The government led the initiative to introduce its own cryptocurrency called S-coin in Seoul, the largest city of the country.

At the time of the crypto boom, the government tried to regulate the market and ended up clamping the blockchain, which broke the investor’s trust in the financial industry. The new law is trying to rectify that by making a statement that the government is now in accord with the blockchains and wants cryptocurrencies as a financial instrument domestically and internationally as well. The legislation is seen as a victory for the Korean fintech startups ecosystems, but it fails to answer many questions around the market.

The law starts a new longterm process of regulating the crypto markets. The cumbersome rulemaking process can potentially take months, if not weeks. It will provide time for the existing startups to transition towards the new regulatory apparatus.

Lastly, Political insiders are also seeing the unexpected turn of events as the government’s way to please people before the election. Though coronavirus is affecting most of the country, the bold step by the government shows that the government is focusing on technology measures too.