It has been reported that Intel’s Arc Alchemist GPUs have seen a significant increase in market share for laptops and desktops within a year of their launch, which has brought them closer to AMD’s market share.

However, there is some uncertainty about the accuracy of Intel’s reported market share figures for discrete GPU shipments.

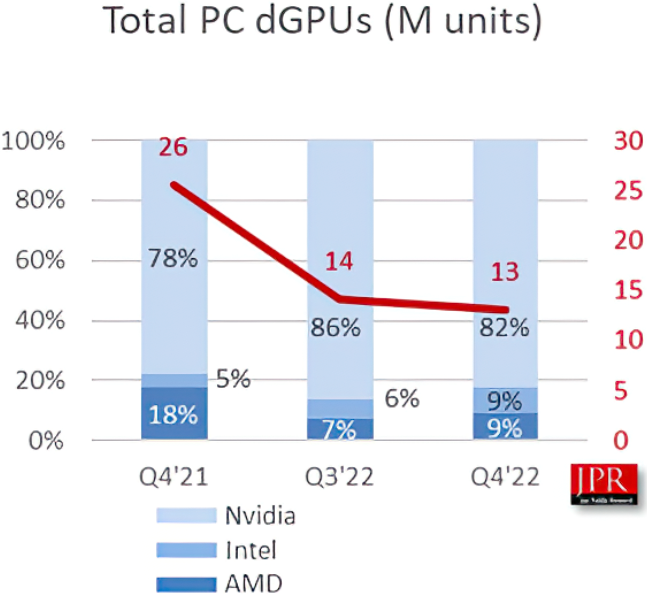

Despite this, Nvidia still holds the top position with over 80% market share for standalone graphics processors. In the fourth quarter of 2022, the three leading discrete graphics processor manufacturers (AMD, Intel, and Nvidia) shipped an estimated 13 million standalone GPUs for desktops, notebooks, and embedded PCs, a significant decline from the 26 million discrete GPUs shipped in the same quarter of 2021 due to weakened demand for PCs, particularly mainstream systems, in the final quarter of the previous year.

Nvidia maintained its dominant position in the standalone GPU market, holding an 82% share, consistent with its strong focus on this industry.

Meanwhile, AMD’s market share dropped from about 18% in Q4 2021 to 9%, while Intel’s share increased from roughly 5% to 9%. The two smaller GPU competitors each shipped around 1.17 million discrete GPUs in the fourth quarter.

However, it’s important to note that the reported market share figures for Intel are based on estimates from the company’s financial statements, so they may not be entirely accurate. It’s possible that AMD still has a higher number of discrete GPU unit sales than Intel.

According to Jon Peddie, the head of Jon Peddie Research, the market share data for discrete GPU shipments reported by Intel is based on estimates derived from their financial statements.

Therefore, Peddie cautioned that one should exercise caution in interpreting the figures and that there should be no excessive enthusiasm about the proximity of shipping levels. The data is influenced by ASPs, considered soft data, and may be unreliable.

Despite the uncertainty surrounding the reliability of Intel’s market share data for discrete GPUs, it is essential to appreciate its success in this sector. I

ntel has been the leading supplier of integrated graphics processors for several decades. Still, its re-entry into the discrete GPU market in late 2020 with the Iris Xe Max was deemed a lackluster offering. However, Intel still managed to secure some designs and claim a slice of the market.

The introduction of the Arc Alchemist GPUs in the beginning of 2022 had a major impact, as it allowed Intel to obtain a considerably larger number of deals with manufacturers of laptops. The high volume of notebook sales represented an important milestone for the company.

While Intel may not be shipping as many standalone GPUs as AMD, the company’s discrete GPU shipments are increasing due to its Arc offerings that target both the desktop and notebook markets.

Certain factors need to be considered for those wondering how Intel managed to increase its discrete GPU shipments despite not having any Arc graphics cards on the market.

Firstly, the data released by JPR pertains to GPU shipments rather than sales, meaning that not all of the shipped GPUs may have necessarily been sold. By assuming that GPUs are shipped first and then sold, it becomes clearer how Intel achieved a 5% market share as early as the end of 2021.

In 2021, Intel most likely shipped DG1 graphics desktop boards and Xe Max dedicated graphics chips for laptops, which contributed to the company’s 5% market share at that time.

However, Nvidia’s dominance in gaming graphics continues to be apparent despite this.

While it may seem like AMD and Nvidia are equally matched in the race for graphics performance supremacy, the reality is that the fight is highly asymmetric. Considering the vast discrepancy in resources and market power between AMD and Nvidia, it might be unjust to fault AMD for not being able to compete with Nvidia on an equal footing.

It could suggest a lack of strength from AMD in the market if Intel has truly achieved parity in unit shipments with their initial Arc GPUs. Observing how this three-way competition between AMD, Intel, and Nvidia unfolds soon will be intriguing.